Thermal Imaging for Disaster Response: OEM Integration Guide

Key Takeaways

The thermal imaging disaster response market presents significant growth opportunities for OEMs and system integrators as emergency management technology demands accelerate.

- Natural disaster management technology market growing from $137.58 billion in 2024 to $326.31 billion by 2032

- Wildfire monitoring, search & rescue, and flood response applications driving integration demand

- Advanced thermal mapping capabilities enabling predictive disaster management systems

- System integrators should evaluate thermal imaging partnerships to capitalize on expanding emergency technology procurement cycles.

Natural disasters continue to intensify in both frequency and severity, creating unprecedented challenges for emergency response organizations worldwide. According to Data Bridge Market Research, the natural disaster management market reached $137.58 billion in 2024 and projects growth to $326.31 billion by 2032, representing an 11.40% compound annual growth rate. This expansion reflects the urgent need for advanced disaster response technologies, particularly systems that can operate effectively in the critical first hours when every decision impacts lives and property.

For OEMs and system integrators, the growing emphasis on thermal imaging disaster response represents a significant business opportunity. Emergency management agencies, defense contractors, and public safety organizations increasingly require sophisticated thermal imaging capabilities integrated into their platforms. Understanding these applications and the technical considerations for effective integration positions forward-thinking system builders to capture market share in this rapidly expanding sector.

What Technology Gaps Exist in Current Emergency Response Systems?

Traditional disaster response technologies face fundamental limitations that thermal imaging solutions can address. Many existing emergency management platforms rely heavily on visible spectrum cameras and satellite data, both of which suffer from significant operational constraints during actual disaster scenarios.

Visibility Limitations in Critical Conditions

Visible spectrum systems become essentially useless in smoke-filled environments, during nighttime operations, or in weather conditions that obscure optical visibility. These limitations severely impact response effectiveness when conditions are most dangerous and time-critical decisions must be made.

Satellite Data Processing Delays

Satellite-based monitoring, while valuable for large-scale assessment, often lacks the real-time responsiveness required for tactical decision-making during active emergency situations. The latency inherent in satellite data processing and delivery can delay critical response actions by hours or even days.

Integration Complexity Challenges

These technology gaps create opportunities for system integrators who can effectively incorporate thermal imaging capabilities into comprehensive emergency management platforms. Organizations need solutions that can function reliably across diverse environmental conditions while providing actionable intelligence to response teams in real-time.

How Does Thermal Imaging Transform Disaster Response Capabilities?

Thermal imaging disaster response solutions excel precisely where traditional technologies fall short. Unlike visible spectrum cameras, thermal sensors detect infrared radiation emitted by objects, enabling operation regardless of lighting conditions, smoke density, or weather visibility. This capability proves invaluable across multiple emergency scenarios where conventional optical systems become ineffective.

Three Critical Operational Advantages

The technology provides three critical advantages for emergency response applications. First, thermal sensors maintain functionality in zero-visibility conditions, allowing continuous monitoring during fires, floods, or severe weather events. Second, they can detect temperature variations that indicate developing problems before they become visible to optical sensors. Third, thermal imaging systems can differentiate between human heat signatures and environmental background temperatures, making them essential for search and rescue operations.

Competitive Positioning Benefits

For system builders, these capabilities translate into competitive advantages when pursuing emergency management contracts. Platforms that incorporate robust thermal imaging solutions can offer clients more comprehensive situational awareness and improved operational effectiveness across diverse disaster scenarios, particularly when paired with precision optical components designed for demanding environmental conditions.

Which Wildfire Monitoring Applications Offer the Greatest Integration Opportunities?

Wildfire monitoring represents one of the most demanding applications for thermal imaging disaster response technology. Fire management agencies require systems that can detect heat sources through dense smoke, track fire progression in real-time, and identify hotspots that pose immediate threats to personnel or property.

Automated Detection System Requirements

Modern wildfire monitoring platforms integrate thermal sensors with automated detection algorithms that can identify temperature anomalies indicative of fire activity. These systems must process thermal data continuously, distinguishing between legitimate fire signatures and false positives caused by equipment, vehicles, or other heat sources.

Long-Range Detection Specifications

Successful wildfire monitoring systems require thermal cameras capable of long-range detection, typically several miles, combined with pan-tilt-zoom mechanisms for detailed investigation of suspected fire activity. The thermal imaging components must withstand harsh environmental conditions including high temperatures, wind, and potential exposure to smoke or ash, requiring specialized optical assemblies engineered for extreme operational environments.

Complete Solution Integration

For OEMs developing wildfire monitoring platforms, the integration opportunity extends beyond basic thermal sensing. Complete solutions require data management systems that can process and analyze thermal imagery, communication networks that relay alerts to response personnel, and user interfaces that present actionable information to fire management teams.

How Do Search and Rescue Operations Utilize Thermal Imaging Technology?

Search and rescue operations present distinct technical requirements for thermal imaging disaster response systems. Unlike wildfire monitoring, which focuses on stationary heat sources over large areas, search and rescue applications must detect human heat signatures while distinguishing them from environmental background temperatures and false targets.

Human Detection Optimization

Effective search and rescue thermal systems require sensors optimized for human body temperature detection, typically in the 8-14 micrometer wavelength range where human thermal signatures are most pronounced. The integration challenge involves configuring thermal processing algorithms that can identify human-sized heat sources while filtering out wildlife, debris, or equipment that might generate similar thermal signatures.

Mobile Platform Considerations

Mobile platform integration adds complexity to search and rescue thermal systems. Whether mounted on drones, vehicles, or handheld devices, thermal imaging systems must maintain calibration accuracy despite vibration, movement, and changing environmental conditions. Understanding the specific technical considerations for drone integration proves critical for system builders developing effective aerial search platforms.

Integrated Solution Opportunities

The business opportunity for system integrators lies in developing complete search and rescue platforms that combine thermal imaging with GPS tracking, communication systems, and data recording capabilities. Organizations evaluating drone thermal imaging cameras for search and rescue operations benefit from understanding how advanced thermal capabilities enhance mission effectiveness while reducing deployment complexity. Emergency response organizations increasingly prefer integrated solutions that allow response teams to coordinate rescue efforts through unified platforms.

Essential System Integration Considerations for Emergency Applications

Successful thermal imaging disaster response system integration requires careful attention to several technical factors that impact system performance and reliability. Understanding these considerations enables system builders to develop robust solutions that meet demanding operational requirements.

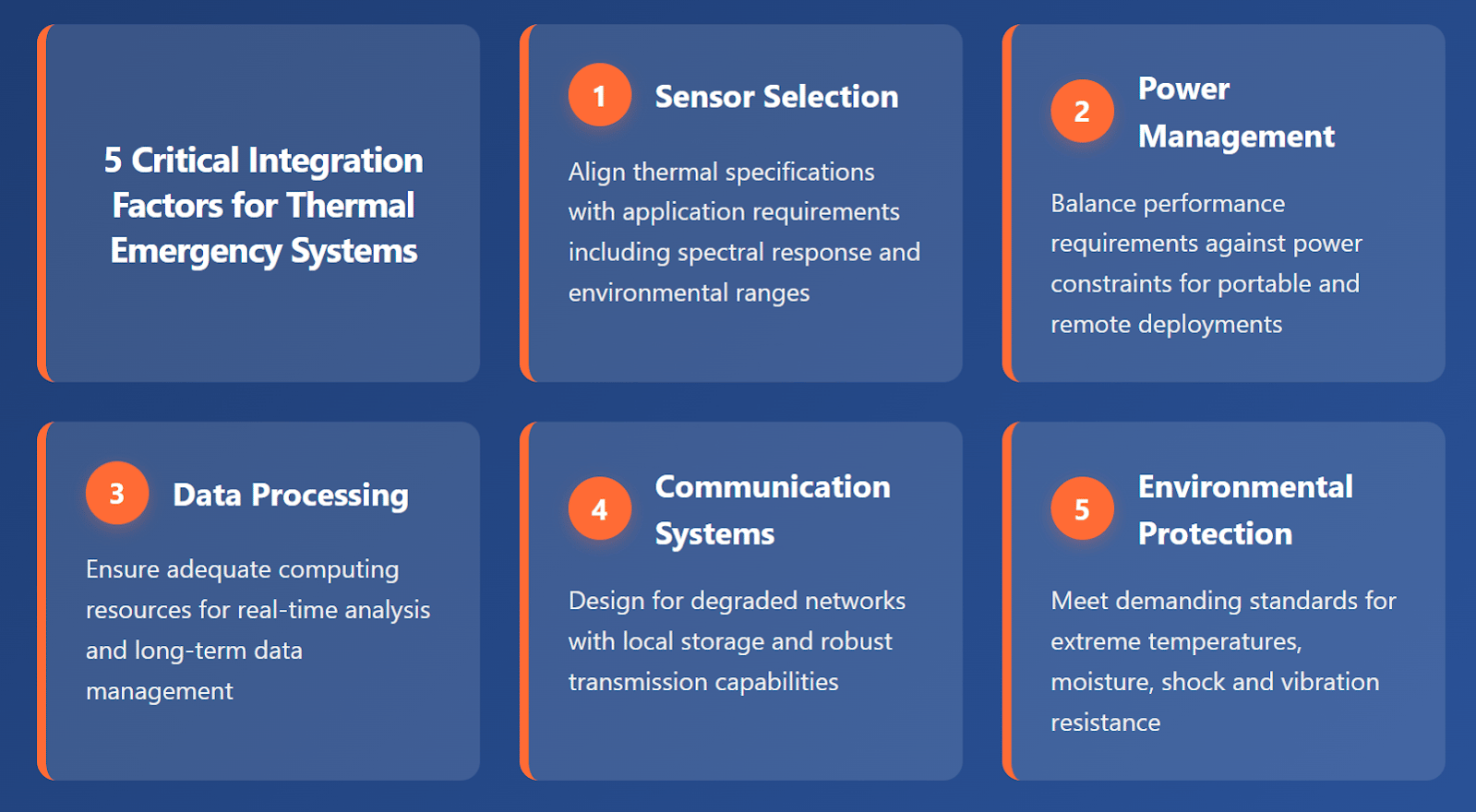

5 Critical Integration Factors for Thermal Emergency Systems

- Sensor Selection Alignment - Thermal sensor selection must align with specific application requirements, considering spectral response, thermal sensitivity, spatial resolution, and environmental operating ranges

- Power Management Strategy - High-performance thermal sensors typically require significant electrical power, particularly for cooled detector technologies that offer enhanced sensitivity

- Data Processing Capacity - Raw thermal data requires substantial computing resources for real-time analysis and long-term trend tracking capabilities

- Communication System Integration - Emergency operations often occur where standard networks are degraded, requiring robust data transmission and local storage capabilities

- Environmental Protection Standards - Systems must withstand extreme conditions including high temperatures, water exposure, shock, vibration, and severe weather

Calibration and Accuracy Requirements

System designers must balance thermal performance requirements against available power sources, considering battery capacity limitations for portable systems or power grid reliability for fixed installations. Thermal imaging lens assemblies play a crucial role in maintaining system accuracy across diverse operating conditions.

Data Management Architecture

Communication system integration presents additional challenges for thermal imaging disaster response platforms. Thermal systems must be capable of storing data locally when communication links are interrupted while providing real-time transmission capabilities when networks are available.

What Market Opportunities Exist for Thermal Disaster Response Systems?

The expanding thermal imaging disaster response market creates multiple revenue opportunities for system integrators and OEMs. The broader incident and emergency management sector, which encompasses both natural and human-caused emergencies, reached $145.24 billion in 2024 according to SNS Insider, with continued growth projected at a 6.24% compound annual growth rate through 2032. Within this larger market, natural disaster management specifically shows even stronger growth potential due to increasing climate-related events.

Government Sector Opportunities

Government agencies represent the largest customer segment, with federal, state, and local emergency management organizations increasingly investing in advanced disaster response technologies. This sector values proven reliability and comprehensive technical support capabilities.

Private Sector Applications

Private sector opportunities include partnerships with utility companies, industrial facilities, and large-scale property managers who require disaster preparedness capabilities. Critical infrastructure operators increasingly recognize thermal imaging as essential for protecting facilities against fire, flood, and other natural disasters.

Service Revenue Potential

Recurring revenue opportunities exist through maintenance contracts, software licensing, and data processing services. Many thermal imaging systems require periodic calibration, firmware updates, and technical support throughout their operational lifecycles.

How Can Organizations Build Effective Thermal Integration Partnerships?

Building effective thermal imaging disaster response solutions often requires partnerships between multiple technology providers. Few organizations possess all the capabilities needed to develop complete emergency management platforms internally, making strategic partnerships essential for market success.

Partnership Structure Considerations

Thermal imaging specialists bring sensor technology expertise and manufacturing capabilities but may lack integration experience with emergency management software platforms. Software developers understand user interface design and data management requirements but need access to thermal imaging hardware and calibration expertise.

Technical Collaboration Requirements

Successful partnerships typically involve clear division of responsibilities, shared development costs, and coordinated go-to-market strategies. Partners should establish technical standards for data formats, communication protocols, and system interfaces early in development processes.

Partner Evaluation Criteria

For organizations considering thermal imaging disaster response system development, evaluating potential partners should include assessment of technical capabilities, manufacturing capacity, customer support infrastructure, and financial stability. Emergency response systems require long-term reliability, making partner selection critical for project success.

Frequently Asked Questions

What are the key technical specifications needed for disaster response thermal systems?

Disaster response thermal systems require sensors capable of detecting temperature differences as small as 0.1°C, operating ranges from -40°C to +150°C, and spectral response optimized for the 8-14 micrometer range where human and fire signatures are most pronounced. Systems must also provide real-time processing capabilities and environmental protection ratings appropriate for emergency conditions.

How do thermal imaging systems integrate with existing emergency management platforms?

Integration typically occurs through standardized data protocols such as TCP/IP networking, GPS coordinate systems, and common video formats. Most modern emergency management platforms support thermal data integration through APIs that allow thermal imagery to be overlaid on mapping systems and combined with other sensor data streams.

What are the typical return on investment timelines for thermal disaster response systems?

ROI calculations for thermal disaster response systems focus primarily on risk mitigation value rather than direct cost savings. Organizations typically justify investments based on potential loss prevention, with payback periods ranging from 3-7 years depending on the scale of deployment and regional disaster frequency.

Which industries show the highest demand for integrated thermal disaster response solutions?

Government emergency services, utilities, industrial facilities, and defense contractors represent the highest-demand sectors. According to market data, government and public sectors account for approximately 28% of emergency management technology investments, with utilities and industrial facilities representing significant growth segments.

What ongoing maintenance and support requirements should integrators plan for?

Thermal imaging systems require annual calibration, regular firmware updates, and preventive maintenance of mechanical components such as pan-tilt mechanisms. System integrators should plan for 10-15% of initial system cost annually for maintenance and support services throughout the typical 7-10 year operational lifecycle.

Capitalizing on the Growing Disaster Response Technology Market

The thermal imaging disaster response sector presents compelling opportunities for system integrators and OEMs positioned to address growing market demands. As natural disasters intensify and emergency response organizations seek more effective technologies, thermal imaging capabilities become increasingly valuable across wildfire monitoring, search & rescue, flood response, and thermal mapping applications.

Success in this market requires understanding the specific technical requirements for each disaster response scenario while developing integrated solutions that combine thermal imaging with complementary technologies. Organizations that can deliver complete platforms rather than individual components will be best positioned to capture market share as customer preferences evolve toward comprehensive solutions.

The business case for thermal imaging disaster response systems continues strengthening as traditional technologies prove inadequate for modern emergency response challenges. System builders who invest in thermal integration capabilities today position themselves advantageously for the expanding opportunities ahead.

For organizations ready to explore thermal imaging integration for disaster response applications, partnering with experienced thermal technology providers can accelerate development timelines while ensuring technical success. Contact our team to discuss how advanced thermal imaging technologies can enhance your disaster response platform development initiatives.